A Stroll Through the 2007 US Sales Results

By Chris Haak

01.09.2008

Late last week, manufacturers released their December 2007 (and therefore final annual) sales results. Overall, the total US light vehicle market (cars and trucks up to class 3) was down 2.9% in December, as well as down 2.5% for all of 2007 compared to 2006. I’m a really numbers oriented person, so I enjoy perusing sales figures, especially when it’s a nice, clean break at the end of a year.

Somewhat surprisingly, with the news of gas prices and the housing slowdown all over the Internet, light trucks were actually down less than cars – 1.9% versus 3.0%, respectively.

Overall, the US Big Three didn’t have a great 2007. Each saw its sales fall: Chrysler LLC was down 3.1%, GM was down 11.8%, and Ford was down 6.0%. Meanwhile, the so-called Japanese Big Three (Toyota, Honda, and Nissan) showed a different story: Honda’s sales were up 2.8%, Toyota’s sales were up 3.1%, and Nissan’s sales were up 4.8%. Detroit’s total sales decline, in terms of actual units, was 651,562 vehicles for the year. The three large Japanese manufacturers saw their US sales increase by 169,474 vehicles for the year. So, where did the remaining 482,088 units go? Some were lost to the overall market decline (407,037 units) while some went to other brands, such as Mazda (up 27,324 units or 10.2%), Hyundai-Kia (up 22,660 units or 3.0%), and BMW Group (including Mini) (up 22,259 units or 7.1%).

Not only did compact and subcompact cars do well (more on that in a moment), but I also find it fascinating the way the opposite end of the automotive spectrum – super-rich luxury vehicles – did in 2008. Rolls-Royce (+5.7%), Bentley (+3.5%), Maybach (+6.8%), Maserati (+20.5%), Lamborghini (+12.3%), Ferrari (+4.7%) all saw sales increases. Something tells me that the wealthy individuals buying these vehicles are neither concerned about the housing slowdown nor the rising cost of gasoline.

And, about those small cars? The Honda Civic (+4.6%), Honda Fit (+102%), Toyota Yaris (+20.6%), Dodge Caliber (+9.6%), Jeep Compass (+112.6%), Chevrolet Aveo (+15.1%), Kia Rio (+17.5%), Hyundai Accent (+3.8%), Mazda3 (+27.4%), Mitsubishi Lancer (+35.4%), Subaru Imprezza (+12.6%), Suzuki SX4 (+37.0%), Mini Cooper (+7.3%), Nissan Versa (+260%), and VW Rabbit (+119.2%) are all small cars that saw sales gains. The few exceptions to this trend included the Toyota Corolla (-4.1%), the Nissan Sentra (-9.7%) and the Hyundai Elantra (-13.3%). The Corolla figures were compared to a strong 2006 (where the car was up 17% in its 5th model year) and the current model is about to be replaced. The Sentra’s problem is that its fraternal competition, the Nissan Versa (widely acknowledged as a spacious subcompact) is up 57,399 units), and eating the Sentra’s lunch (the Sentra was down 11,400 units).

And, about those small cars? The Honda Civic (+4.6%), Honda Fit (+102%), Toyota Yaris (+20.6%), Dodge Caliber (+9.6%), Jeep Compass (+112.6%), Chevrolet Aveo (+15.1%), Kia Rio (+17.5%), Hyundai Accent (+3.8%), Mazda3 (+27.4%), Mitsubishi Lancer (+35.4%), Subaru Imprezza (+12.6%), Suzuki SX4 (+37.0%), Mini Cooper (+7.3%), Nissan Versa (+260%), and VW Rabbit (+119.2%) are all small cars that saw sales gains. The few exceptions to this trend included the Toyota Corolla (-4.1%), the Nissan Sentra (-9.7%) and the Hyundai Elantra (-13.3%). The Corolla figures were compared to a strong 2006 (where the car was up 17% in its 5th model year) and the current model is about to be replaced. The Sentra’s problem is that its fraternal competition, the Nissan Versa (widely acknowledged as a spacious subcompact) is up 57,399 units), and eating the Sentra’s lunch (the Sentra was down 11,400 units).

So, if small cars were up, big cars were down, right? Not necessarily; the Dodge Charger was up 4.5%, the Volvo S80 was up 125.8%, and the Chevrolet Impala was up 7.3%.

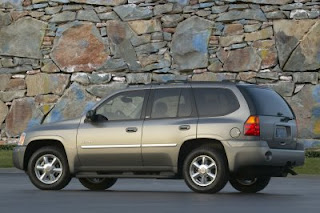

Taking a pretty rough beating were body on frame SUVs, specifically midsize ones. Overall, that market was down 20.0%, and of the nine models in the segment, not one saw a sales increase, and the smallest decrease was the Toyota FJ Cruiser(down “only” 1.9%). Overall, the midsize body on frame SUV segment lost 141,044 sales from 2006 to 2007. Rounding out this category were the Isuzu Ascender (-39.3%), Mercury Mountaineer (-19.3%), GMC Envoy (-34.7%), Nissan Pathfinder (-13.8%), Nissan XTerra (-17.6%) Toyota 4Runner (-14.9%), Saab 9-7x (-9.2%) Ford Explorer (-23.1%), and Chevrolet TrailBlazer (-23.0%). It’s interesting to see the Explorer’s fall from grace – it was once one of the top selling vehicles in the US, with over 400,000 annual sales, but now Ford is only moving about a third of that volume (137,817 in 2007). My theory on the near-extinction of the traditional midsize SUV is that they don’t do anyting particularly well. What I mean is, they get similar fuel economy to a full size body on frame SUV (for instance, a 2008 Pathfinder 4×4 V6 is rated 14/19, which is the same rating as the Chevrolet Suburban 4×4), they have much less passenger space than a similarly-sized crossover, and can’t tow as much as a full-size SUV. So basically, the runup in gasoline prices has separated the people who actually need an SUV from those who bought one for image reasons. The people who need an SUV or large family hauler are either going to buy a full-size SUV (this segment was down 4.2% compared to 2006, and would have only gone down 2.7% if Toyota Sequoia sales hadn’t tanked in anticipation of the new (ahem) larger model). Also, GMC Envoy sales likely suffered worse than TrailBlazer sales did because the Envoy has the Acadia in the next parking space offering better looks, better fuel economy, and better interior space and comfort. Chevy does not yet sell a large crossover to “compete” with its own TrailBlazer.

Taking a pretty rough beating were body on frame SUVs, specifically midsize ones. Overall, that market was down 20.0%, and of the nine models in the segment, not one saw a sales increase, and the smallest decrease was the Toyota FJ Cruiser(down “only” 1.9%). Overall, the midsize body on frame SUV segment lost 141,044 sales from 2006 to 2007. Rounding out this category were the Isuzu Ascender (-39.3%), Mercury Mountaineer (-19.3%), GMC Envoy (-34.7%), Nissan Pathfinder (-13.8%), Nissan XTerra (-17.6%) Toyota 4Runner (-14.9%), Saab 9-7x (-9.2%) Ford Explorer (-23.1%), and Chevrolet TrailBlazer (-23.0%). It’s interesting to see the Explorer’s fall from grace – it was once one of the top selling vehicles in the US, with over 400,000 annual sales, but now Ford is only moving about a third of that volume (137,817 in 2007). My theory on the near-extinction of the traditional midsize SUV is that they don’t do anyting particularly well. What I mean is, they get similar fuel economy to a full size body on frame SUV (for instance, a 2008 Pathfinder 4×4 V6 is rated 14/19, which is the same rating as the Chevrolet Suburban 4×4), they have much less passenger space than a similarly-sized crossover, and can’t tow as much as a full-size SUV. So basically, the runup in gasoline prices has separated the people who actually need an SUV from those who bought one for image reasons. The people who need an SUV or large family hauler are either going to buy a full-size SUV (this segment was down 4.2% compared to 2006, and would have only gone down 2.7% if Toyota Sequoia sales hadn’t tanked in anticipation of the new (ahem) larger model). Also, GMC Envoy sales likely suffered worse than TrailBlazer sales did because the Envoy has the Acadia in the next parking space offering better looks, better fuel economy, and better interior space and comfort. Chevy does not yet sell a large crossover to “compete” with its own TrailBlazer.

Other former midsize SUV buyers are moving to crossovers, which have much of the style, more passenger space given the exterior footprint, and are more fuel efficient. Want to know where those 400,000 Explorer sales went? The RAV4 (172,752) and CR-V (219,160) are the two top-selling crossovers, and combined sold 391,912 units. As a segment, crossovers generally did very well, including the Edge, MKX, Acadia, Outlook, RDX, MDX, RAV4, CR-V. Some crossovers lost sales, but those were generally models due for replacement or cancellation soon, such as the Murano, PT Cruiser, Torrent, Pilot, Equinox, Tucson, and Endeavor. Excluding models that weren’t sold in 2006 such as the Mazda CX-9, Buick Enclave, and Jeep Patriot, as well as models sold in 2006 but not in 2007 such as the Buick Rendezvous, the segment was up about 20%, or 313,000 units. Not bad in a falling market!

Other former midsize SUV buyers are moving to crossovers, which have much of the style, more passenger space given the exterior footprint, and are more fuel efficient. Want to know where those 400,000 Explorer sales went? The RAV4 (172,752) and CR-V (219,160) are the two top-selling crossovers, and combined sold 391,912 units. As a segment, crossovers generally did very well, including the Edge, MKX, Acadia, Outlook, RDX, MDX, RAV4, CR-V. Some crossovers lost sales, but those were generally models due for replacement or cancellation soon, such as the Murano, PT Cruiser, Torrent, Pilot, Equinox, Tucson, and Endeavor. Excluding models that weren’t sold in 2006 such as the Mazda CX-9, Buick Enclave, and Jeep Patriot, as well as models sold in 2006 but not in 2007 such as the Buick Rendezvous, the segment was up about 20%, or 313,000 units. Not bad in a falling market!

Lastly, let’s look at the largest segment of the market, though the one that had the most trouble at the end of the year. Toyota made a bold prediction when it launched the 2007 Tundra that its first year sales goal was 200,000 units. After the truck got off to a slow start, Toyota started increasing incentives and sales took off. The Tundra finished 2007 just 3,445 units shy of its goal (196,555), but up a whopping 57.9%. Even with that dramatic increase, the overall full size pickup market was down 3.0% compared to 2006, but without the Tundra, the segment would have gone down 6.6%. The Tundra’s sales increase for 2007 in a declining market shows that it is taking sales away from the other trucks in its segment. Ford and Dodge are fighting back in 2008, however, and the 2009 F-150 and Ram, respectively, will be making their worldwide debuts this weekend in Detroit. Ford really needs the help; the F-series was down 13.2% in 2007, and down a whopping 22.0% in December 2007.

Lastly, let’s look at the largest segment of the market, though the one that had the most trouble at the end of the year. Toyota made a bold prediction when it launched the 2007 Tundra that its first year sales goal was 200,000 units. After the truck got off to a slow start, Toyota started increasing incentives and sales took off. The Tundra finished 2007 just 3,445 units shy of its goal (196,555), but up a whopping 57.9%. Even with that dramatic increase, the overall full size pickup market was down 3.0% compared to 2006, but without the Tundra, the segment would have gone down 6.6%. The Tundra’s sales increase for 2007 in a declining market shows that it is taking sales away from the other trucks in its segment. Ford and Dodge are fighting back in 2008, however, and the 2009 F-150 and Ram, respectively, will be making their worldwide debuts this weekend in Detroit. Ford really needs the help; the F-series was down 13.2% in 2007, and down a whopping 22.0% in December 2007.

There are a million different ways to look at sales data, but the biggest takeaway is that we’ll probably see a completely different picture a year from now when we repeat this exercise. Predictions of even higher gas prices and a declining US auto market could shake things up even more. Will crossovers continue their rise? Will consumers continue to flock to small cars? Stay tuned.

COPYRIGHT Full Metal Autos – All Rights Reserved