April Sales Results are Good, Not Great

By Chris Haak

The auto industry still has a big, big hole to dig out of to get anywhere close to the volumes of the peak years earlier in the last decade, when 16 and 17 million unit annual new-car volumes were the norm. Sales volumes are still on the upswing relative to 2009’s pitiful performances, but the SAAR (seasonally-adjusted annual rate) dropped slightly from March’s incentive-fueled 11.7 million rate to 11.5 million in April 2010. Overall industry sales were up 20 percent, so any company topping that number is gaining market share.

As has been the trend in the past several months, Ford was again a big winner, with a 25 percent overall gain and a 32 percent retail gain; Ford’s March results were somewhat fueled by government and commercial fleet sales (allegedly not so much daily rental sales), so the retail strength is good news for Ford transaction prices and residual values. Ford’s venerable F-series trucks saw a 42 percent increase, while the aging Escape crossover leaped 41 percent over the year-ago period.

Chrysler pulled off its first double-digit monthly gain in half a decade, with a 25 percent increase. Chrysler did not break out the retail/fleet mix, with many taking that as an ominous sign. The company has committed to reducing its fleet mix during the course of 2010, and of course, a few reinforcements with Italian accents are on the way, in the form of the Fiat 500 and a number of other Fiat-based models over the next two years. The 2011 Jeep Grand Cherokee is starting production as we speak, and a rebodied Chrysler 300 and Dodge Charger are each coming this fall.

The news was somewhat mixed for GM. Remembering that GM now has four ongoing brands (Chevrolet, Cadillac, Buick, and GMC) and four that are being wound down or were sold (Pontiac, Saturn, Hummer, and Saab), year-to-year comparisons are difficult. However, the company’s overall sales were up 7 percent, and sales of the four surviving brands were up 20 percent. Both numbers lagged the market, meaning that GM is bleeding market share, which Ford and others are snapping up. GM’s Silverado was up just 12 percent, and the Sierra was up just 13 percent; compare those numbers to Ford’s F-series sales spike to see who’s grabbing pickup market share.

Another market share grabber is Nissan. The Japanese automaker’s April 2010 sales were up 35 percent, with 11 different Nissan models showing double-digit increases, on the way to a 34 percent sales gain at the Nissan division. Nissan’s Infiniti luxury division did even better than the Nissan brand did, with sales up 46.2 percent, on the back of the G (up 54 percent) and the new-for-2011 M (up 174.8 percent).

Honda’s sales were up 13 percent, which means that it also lost market share in April. Surprisingly, Honda car sales were actually downin April, albeit by just 1.4 percent. This could also explain why Honda has decided to go against its normal playbook and offer very generous lease deals at this time. Honda/Acura trucks powered the sales increase that the company did see, with Pilot, MDX, CR-V, and Odyssey sales. The ZDX, which is a nice (if impractical) vehicle, sold just 234 units in April.

And then there’s Toyota. The world’s largest automaker managed to basically hold onto its US marketshare, with sales coming in up 24 percent. The Toyota division’s sales were up 23.8 percent, and the Lexus division saw sales increase by 29.3 percent. Corolla sales led the way for Toyota, with a 50.7 percent increase. The Prius (up 49.7 percent) and the redesigned Avalon (up 36.1 percent) also did well for Toyota. At Lexus, the sales gain came mainly on the back of a new model (the HS) and on the flagship LS sedan, which was up 54.5 percent. The 4Runner (up 204.3 percent), Sienna (up 40.6 percent), Tundra (up 45.4 percent) and RAV4 (up 33.3 percent) led the way for Toyota trucks. The Lexus GX, in spite of its Consumer Reports test controversy, and subsequent stop-sale and recall, still managed to leap 47.7 percent. Toyota’s biggest losers were the entire Scion lineup and the Sequoia full-size SUV.

Subaru again dazzled the industry with a 48 percent sales increase, which was the company’s best April sales results ever, topping even pre-doomsday April 2008 by a solid 38 percent. The biggest winner for Subaru was its new Outback, with sales up 133 percent, and its Legacy sedan, with sales up 50 percent from year-earlier levels. My favorite Subaru, the Forester, was up a solid 28 percent, in spite of having been on the market for more than two years. Only the unloved Tribeca’s sales fell at Subaru; with its lousy 236 units sold, the company might as well cut its losses and give up on the thing.

Korean auto giant Hyundai (which includes Kia) saw its sales climb a market-matching 24 percent. The Hyundai brand was up 30 percent, with the Sonata notching an excellent 57 percent gain, the Elantra rising 106 percent, and the Santa Fe jumping 59 percent. On the other hand, the Veracruz was down 54 percent, the Accent was down 42 percent, and the Genesis was up just 9 percent. The Genesis results are surprising, considering that the lower-cost coupe has been added to the lineup since last April’s comparative period. Kia was up a market-lagging 17 percent, but the all-new 2011 Sorento slaughtered its inferior predecessor, with sales up 252 percent. The fairly-new Soul was up 62 percent, but other Kia models either saw either slight declines or slight increases. When the new Optima hits the market this fall, expect to see Kia’s sales results on fire again.

Volkswagen, though a niche player in the US (albeit with big dreams) is one of the world’s largest automakers. The German company posted a 42 percent sales increase in the US in April, thanks to the new Golf (up 113 percent), GTI (up 223 percent), Jetta (up 62 percent), New Beetle (!) (up 35 percent), Passat (up 28 percent), CC (up 38 percent), Tiguan (up 57 percent), and new Touareg (up 64 percent). Only the Chrysler-built Routan minivan saw a sales decline; its volumes were down 43.4 percent. Before you ask, “why bother with the Routan,” note that it sold more units than the Golf, Passat, and Touareg did. It’s also a pretty nice minivan, and one that I’d probably prefer to its Pentastar-branded cousins.

Scrappy Suzuki appears to finally see its sales results leveling off (though still falling). Some might say they’re bottoming out; the Japanese purveyor of small cars and motorcycles saw its light-vehicle sales fall another 23 percent. That’s still much better than the 74 percent decline that Suzuki saw earlier in the year as the market roared past them, but at least the very good Kizashi midsize sedan – which I really enjoyed driving – is inching up in the sales charts, with 406 units going across the block. Our number one rule of sales results press releases comes true again, though: when automakers compare results to the previous month, it’s bad news. Suzuki noted, “Kizashi and Equator sales increase for fourth consecutive month.”

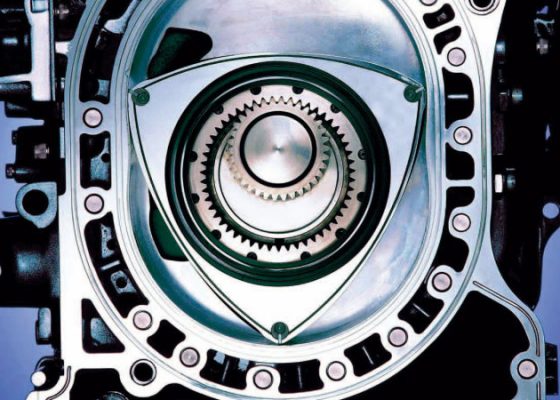

Japan’s other automaker that struggles in the US market, Mitsubishi, saw its sales basically flat, with them increasing by just 13 units. That’s 13 units, not 13 percent: from 3,919 to 3,932. Mazda’s sales increased by 17 percent, BMW increased a market-lagging 9 percent, Daimler AG increased 19 percent, and Jaguar Land Rover increased 10 percent. Volvo, now owned by China’s Geeley, did not report US sales results for April 2010.