GM and Ford Should Exit Europe

Want to see GM’s stock price recover to something closer to the IPO price or – gasp – closer to the price at which Treasury would actually break even on its bailout of GM? Perhaps the answer is addition by subtraction. Maybe it’s time for GM to cash in its chips in Europe and put Opel, Vauxhall, and Chevrolet (the Europe version) out of their misery and sell them. And if nobody wants to buy them (a very strong possibility), GM should wind down the businesses.

Remember when GM slid into bankruptcy in 2009 and almost everyone (except for Pontiac fans, that is) argued that GM had too many brands given the size of its market share, and that one or more of them would have to be wound down? The thinking is – and it was correct, I believe – that having fewer “mouths” (brands, in this case) to feed meant that there was less intramural rivalry and engineering resources were not being spread across too many models. Why build three mediocre midsize sedans when you can just build one really good one? And more importantly, why pay for three marketing budgets to try to sell what is basically the same car badge-engineered into different brands when that money would be much more effective in selling a single vehicle under a single brand’s name?

Keeping that in mind, let’s look at the auto industry in Europe. It’s a complete disaster. There are too many plants, not enough sales, and too many brands. Sounds a lot like GM, Ford, and Chrysler, circa 2006, doesn’t it? (Except of course we’re talking about a bigger picture, since this is the eurozone’s auto industry). Capacity needs to be removed from the system.

One way to do that is to close a few plants. GM and Ford are doing that; we reported earlier this week that closing its Genk, Belgium plant and displacing that plant’s workers will cost $750 million USD, which is a not-small sum of money. GM announced yesterday that it’s closing its Bochum, Germany plant in late 2014 after workers there rejected a cost-saving agreeement. That will cost GM a fortune.

Ditching Opel

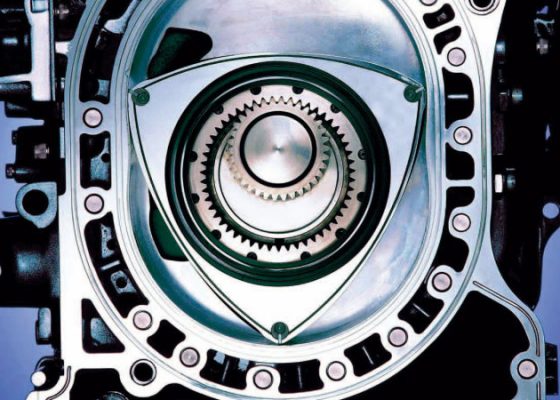

But there really is another way. GM was very, very close to selling Opel to Magna, a Tier 1 supplier to various automakers that has had a dream to produce its own branded models one day – in other words, becoming a full-fledged OEM, not just a supplier to OEMs. But in late 2009, GM reversed course, deciding that Opel was of critical strategic importance to GM’s development process and its desire to remain a top-selling global automaker.

To be sure, abandoning Europe would be a huge blow to GM’s prestige. Quite possibly, it could be a step that the automaker is unwilling to take solely for that reason. Forget the horse race among VW, Toyota, and GM for the title of world’s largest automaker; take Europe out of GM’s sales volume and GM’s a distant third to the other three.

But really, does Europe matter to GM? Currently GM’s engineering resources in Europe are primarily working on global midsize cars such as the Opel Insignia/Buick Regal and Chevrolet Malibu, plus Europe-exclusive products. Is there anything so amazing about the Epsilon II platform that the work can’t be transitioned to the United States, or even to Korea or China? Cars whose platforms were developed in Europe are sold all over the world. Competitors to the GM vehicles originally developed in Europe are developed in large part outside of Europe.

During the past 10 years, Opel has lost a staggering amount of money – $16 billion since 1999. In 2012 alone, Opel lost $1.8 billion. Under GM’s predictions, Opel will not break even until “mid-decade” – which is two or three years away, saying nothing of actually making money.

Opel is a damaged brand. GM can try to move it upscale all it wants, but the fact remains that most Opels that are sold go to fleets or rental-car agencies. Retail buyers aren’t going to flock to the local Opel dealer. The European auto market would be well-served by an Opel exit. It would take several plants offline, and there would be less competition for each sale. Would-be Opel buyers would then buy Volkswagens, Fiats, Peugeots, Renaults, Fords – whatever. That spillover effect would then improve the results of those companies, as their plants need to pick up some of the slack that Opel’s departure would cause. Plus, they wouldn’t have to compete against deep fire-sale discounts that Opel is forced to undertake to move the metal today.

When I alluded earlier to the effect that dumping Opel might have on GM’s stock price, such a move has actually been quantified by Morgan Stanley (and reported by The Economist) back in September 2012. The result: Opel is likely to lose even more money over the next 12 years than it did over the previous very ugly 12 years. Morgan Stanley assigned a value of minus $17 billion to Opel. If they’re correct, it means that just having the Opel albatross around GM’s neck is pulling the stock price down by about $10 per share.

There are two very divergent paths that GM might take if it decides to get rid of Opel. Selling it would of course require finding a buyer, which is easier said than done. On one hand, it would allow GM to recover some value from Opel (though with a minus $17 billion value, it’s hard to imagine any buyer paying anywhere near what GM may have gotten from Magna for Opel in 2009). On the other hand, selling Opel would mean that much of the excess capacity (and excess brands) would still exist in Europe. In other words, there is a structural problem that selling the problem company will not solve.

Shuttering Opel would partially solve the capacity problem for Europe’s automakers (though probably not completely), which would be GM’s gift to its competitors in the Old World. But even more, it would finally put a tourniquet on a wound that has been bleeding GM dry for more than a decade – and will likely continue to do so for years to come. Sure, there would be a short-term hit with severance charges, plant closures, a reserve for warranty claims, dealer settlements, etc. But then Opel would be out of GM’s hair, the red ink would stop gushing from Europe, and GM could concentrate on its healthy businesss in the rest of the world. If GM ever wanted to re-enter Europe at some point, it could do so with an alliance with an existing smaller European automaker, or by buying one of them outright.

Ford Too?

Though not in as much of a crisis as GM is in, Ford’s European operations are still a mess. Over the past three months, Ford has attempted to rein in excessive incentive spending, but that caused falling sales. Ford Europe’s past three months were the weakest (in terms of declines) of any volume brand in Europe. The company had originally expected its European operations to lose $1.5 billion during 2013; it has since increased the size of that loss forecast to $2.0 billion. That’s serious money that would

Like GM, Ford is feverishly working to reduce its Europe production capacity, with three announced plant closures. But, with the backdrop of collapsing sales, three plant closures are still likely not enough to get the company’s European operations back in the black. That means either further losses in coming years, or further capacity reductions (which means layoffs and/or plant closures).

Would Alan Mulally like to insulate the parent company from Ford Europe’s $2 billion loss? I’m sure he would. But just as GM is likely thinking, Ford has a long history of selling cars in Europe (not to mention developing them there, and now for global markets) and it would not be easy to just hack off Europe, pay some severance money, and move on.

Still, you have to wonder if executives at these companies are thinking about doing so. Europe looks terrible economically – not just in the car business, but certainly the car business is feeling the effect of austerity measures put in place by governments, runaway unemployment (Spain’s unemployment rate is a staggering 26.6 percent!) and the huge overhang of public debt. Europe is years (if not more than a decade) away from fixing its structural problems. The Euro is on the verge of losing its first member if Cyprus can’t get its banking sector straightened out by Monday. If I were the CEO of GM or Ford, I’d have my staff working on contingency plans to get the hell out of Dodge.

Fiat/Chrysler

Speaking of Dodge, we haven’t talked about Fiat. Fiat and Chrysler CEO Sergio Marchionne must thank God every night that the U.S. government gave him Chrysler in 2009. Without Chrysler backstopping Fiat’s losses, he’d be screwed. Fiat would probably be bankrupt. Marchionne has taken a completely different path than GM or Ford have. It remains to be seen whether his strategy of increasing production to improve plant utilization will be the right one. If he’s wrong, he may be out of at least one of his jobs – and the good ship Fiat may sink.

It’s not a fun time to be an auto executive in Europe. That is, unless you’re lording over a premium brand like BMW, Mercedes-Benz, or Ferrari – or if your sales are so well-diversified and your balance sheet so healthy that you can nearly shrug off Europe’s poor results and take share from weaker rivals, as Volkswagen is doing.