Ready For a 97 Month Car Loan?

Except for the fact that I don’t like the idea of “renting” the car that I’m driving, and therefore have always chosen buying over leasing, I’m probably an ideal candidate for leasing a car. I quickly grow tired of a new car that I own, prowling the build-your-own section of various websites, the eBay Motors classifieds, and more. I don’t put many miles each year on my own car, and I hate the idea of selling my old car (or worrying about being gouged by a dealer on the trade-in).

It seems that there must be other people who really, really want to finance a car loan over leasing, because the average new-car loan is creeping ever longer. According to data from credit-ratings firm Experian cited by The Wall Street Journal, the average car loan duratin is now a record 65 months. But as anyone with almost any exposure to averages can tell you, there are probably some really long loans pulling up that average and offsetting the people with 36 and 48 month loans on the other end of the spectrum.

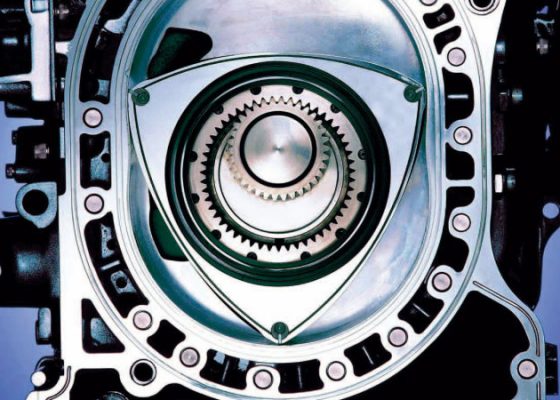

Experian noted that 17 percent of car loans today are between 73 and 84 months (basically, between six and seven years), with some as long as 97 months. Just think about that for a minute: if you bought a new car today on a 97 month car loan, you’ll be making payments for eight years on your new car. My dad, who’s in the car business, always says, “everyone drives a used car,” which is true – but making payments on a “new” eight year old car would just suck. Take it from me, who typically regrets five-year loans. My family’s last four car loans were of the 60-month variety. The first ended prematurely when we traded that vehicle in for a minivan. We finished the payments on the minivan. I’m nearly finished making payments on my daily driver. The fourth is our 2013 Toyota Sienna XLE AWD.

My 2008 Cadillac (the one that’s almost paid off) has been a good car for us, but I stil can’t wait to replace it. I’ve grown tired of its poor fuel economy, sunroof squeaks, and antiquated navigation system. I want a lighter, more nimble car than its 3850-pound heft. And I’m only at the five year point. Granted, it’s entirely possible that I will have this car in three years when some poor saps would still be making payments on their 97-month loans, but at least I will only resent the car because of the car and because there’s something better out there, not because I’m still paying for the damn thing.

The appeal of long car loans, of course, is that they allow lower monthly payments. But there’s a cost to both the people selling the cars and the people buying the cars (beyond just being stuck with payments on a pretty-old car). Buyers are not getting interest-free loans for 97 months. It’s just not happening. Typically the buyers who are concerned about the size of their monthly payments rather than negotiating the best possible deal are encountering more financial struggles than other buyers are. They’re not going to have great credit (higher interest rates) and they may be rolling the balance of an upside-down car note into their new loan (higher payments).

For dealers and auto manufacturers, the peril of long car loans is that buyers are les likely to be coming back for their next car anytime soon, while in contrast, leasing customers are typically coming back for a new car every three years or so.

Before you sign on the dotted line for a 97 month (or even 84 month, or 72 month) car loan, think about the 2005 Malibu pictured at the top of this post. That car is eight years old. Would you really want to still be making payments on that car today? I know that I sure would not want to.