Ford sales up 122 percent…

…in Russia.

By Chris Haak

07.18.2007

For all the tears shed, hands wrung, and red ink spilled about Ford’s problems in the US market for the past year or two (namely a $12.6 billion-with-a-B loss in 2006 and falling sales and market share), there is at least one part of the world where Ford can literally do almost no wrong: Russia.

For all the tears shed, hands wrung, and red ink spilled about Ford’s problems in the US market for the past year or two (namely a $12.6 billion-with-a-B loss in 2006 and falling sales and market share), there is at least one part of the world where Ford can literally do almost no wrong: Russia.

Take almost everything that is wrong with Ford in its home market – a truck-heavy lineup, a marginally competitive small car, and unrealistic MSRPs (hence the perpetual $7,000 rebate on Lincoln Town Cars), and Ford does not have any of those issues in Russia. In fact, year to date Ford sales are up in Russia by 122% through June 30, while the overall market was up 70% in 2006.

In Europe, expensive gasoline and a more pragmatic approach to transportation means that few if any non-industrial buyers purchase pickup trucks or full-size SUVs. Although the US market is trending away from these vehicles, they are still very much a part of Ford’s US lineup (as well as GM’s and Chrysler’s). However, as US buyers’ tastes shift away from large vehicles, Ford’s product plans have not yet caught up to consumer tastes. In Europe, and Russia in particular, the product mix pretty much already matches what buyers want, and are likely to want in coming years. Throw a growing economy flush with oil revenue (wages up 28% in April 2007 versus April 2006) into the mix, and the result is stratospheric sales gains.

Instead of talking about what Ford does wrong in the US, let’s look at what they did right in Russia. Part of Ford’s success is probably luck, and part can be attributed to good management.

Ford laid the foundation for its success in Russia by becoming the first foreign-owned automotive company to build a production line in Russia, in St. Petersburg, so the company enjoyed a first mover advantage. St. Petersburg has become a “Russian Detroit,” as Nissan and Toyota later announced plans to build vehicles there, and other facets of a nascent automotive industry sprang up in the area. Ford currently has capacity to produce 72,000 Focus compacts at its St. Petersburg facility, but just announced plans on July 10 to spend $100 million to expand the plant to produce an additional 28,000 Focuses (100,000 total) plus 25,000 Mondeo midsize cars.

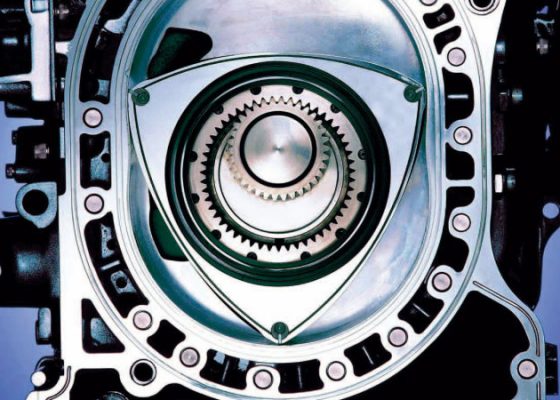

As far as having the proper product mix for the local market, Ford’s lineup in Russia is anchored by the Focus. Yes, the Russians get the “good” Focus (on the well-regarded C1 platform, which also underpins the Mazda3, Volvo S40, and others). The Focus starts at just $12,000 and is well within reach of the Russian middle class, particularly with readily available financing. The Focus is so popular in Russia that at its launch, customers had to endure six month waiting lists to buy one. There are still waiting lists, but they’re now at three or four months. It’s the best selling import brand vehicle in Russia, beating out strong competitors such as Toyota, Nissan and Mitsubishi.

If only Ford was able to emulate its success in Russia in the US, we might be having very different conversations about Ford’s future today. Unfortunately, though the Russian Ford sales are way up, they also represent only a small portion of Ford’s global sales (115,985 units out of 6.6 million) so aren’t really helping the bottom line at this point. However, analysts believe that in the next few years, Russia could become the largest car market in Europe, and Ford appears to be sitting in a great position to capitalize on that.

COPYRIGHT Full Metal Autos – All Rights Reserved