Obama Announces Chrysler Bankruptcy, Says It Will Be Quick

04.30.2009

And so here we are, at another crossroads in the star-crossed history of Chrysler. Today at a noon news conference, President Obama announced that Chrysler would enter Chapter 11 bankruptcy protection today, and would also enter into its much-discussed alliance with Italy’s Fiat SpA.

And so here we are, at another crossroads in the star-crossed history of Chrysler. Today at a noon news conference, President Obama announced that Chrysler would enter Chapter 11 bankruptcy protection today, and would also enter into its much-discussed alliance with Italy’s Fiat SpA.

It’s hard to think of another company that has lurched from boom to bust, back and forth, so many times over the past few decades. Even in my relatively short 34 years, it’s happened a number of times. Bust: Chrysler nearly declared bankruptcy in the late 1970s until Lee Iacocca got federal loan guarantees that saved the company. Boom: The K-car’s success allowed the company to pay back the loans early, and Iacocca’s minivan program was a smash hit in the marketplace, allowing the company to buy AMC to get the coveted Jeep name. Bust: But the company became overly reliant on cars that shared the Reliant’s platform (how’s that for irony?), with most front wheel drive cars, from the K-car to the New Yorker and minivans, sharing a variant of the K’s platform. Boom: Then the company’s products improved, beginning with the Viper sports car, the Eagle Premier-based LH large cars, the Neon, the Ram pickup, and others. During the time in the early- to mid-1990s when Chrysler was finding its styling mojo again, it was also improving production efficiency and was able to capitalize on a booming SUV market with Jeep and Dodge products. Bust: Daimler-Benz acquired the company in an unequal “merger of equals,” gutted the company’s management, and watched Chrysler enter yet another bust period. Boom: Daimler sent Dieter Zetsche to Michigan to serve as Chrysler’s CEO, and on the back of low fuel prices and rear wheel drive performance cars such as the Chrysler 300, Chrysler contributed significantly to DaimlerChrysler’s bottom line while Mercedes-Benz was struggling with quality issues. Bust: Then Chrysler’s gutted, uncompetitive lineup failed to gain traction in the marketplace in an era of high gas prices, which resulted in the company’s sale to private-equity firm Cerberus in 2007, and continuing struggles that take us to today’s bankruptcy filing.

For those keeping score, since 1979, there have been three “booms” and four “busts.” It must be “boom” time again soon, according to the pattern. President Obama said that he believed that Chrysler would not just survive with the Fiat alliance, but thrive. According to people familiar with the auto task force’s discussions, no further job cuts are expected while the company is in bankruptcy protection, and the bankruptcy will likely be a quick one, with an exit in 30-60 days since most parties have already agreed to the necessary concessions outside of bankruptcy court.

During the news conference, the President lauded the dramatic concessions made by nearly all stakeholders, but also was clearly annoyed at the holdout debt holders, who refused to accept the government’s offer of taking pennies on the dollar for their Chrysler debt. Chrysler’s largest bondholders, including Citigroup and J.P. Morgan, did accept the government’s offer to reduce Chrysler’s debt, and yesterday, Chrysler’s UAW members overwhelmingly approved a concessionary contract that will save the company money. Cerberus, Chrysler’s owner for the time being, is giving up its equity stake in the automaker, as Daimler AG has also done with the 19.9% of the company that it held onto after the sale of 80.1% of the company to Cerberus. Chrysler’s bankruptcy declaration is a sign that the government is willing to take a tough stance against debt holders who refused to accept the government’s proposal. The holdouts may have credit-default swaps that would pay out in the event of Chrysler’s bankruptcy, making Chapter 11 a more lucrative alternative for them. Obama seemed to express the most vitriol toward that group during the news conference, saying that he wasn’t willing to give those lenders a government-paid bailout that in effect gave them double the return of other stakeholders.

President Obama noted that Americans should consider buying American cars, and can do so with confidence, since the government has stepped in to guarantee Chrysler and GM warranties. In terms of stimulating some auto sales demand, he said that the government is likely to purchase significant numbers of fleet vehicles from domestic manufacturers in the coming months, and that his administration is working with Congress to approve a program that provides an incentive to buyers of new fuel-efficient vehicles to trade in older, less-efficient ones (a “cash for clunkers,” or if you prefer, “cash for bangers” program).

Another somewhat dramatic piece of news is that GMAC (GM’s former finance arm, owned 51% by Cerberus and backed by the Federal government) is acquiring Chrysler Financial (also owned by Cerberus). GMAC will provide dealer and consumer financing for Chrysler vehicles, and the government will make additional funds available to GMAC to encourage more lending.

Below are Chrysler’s own words about the Fiat alliance:

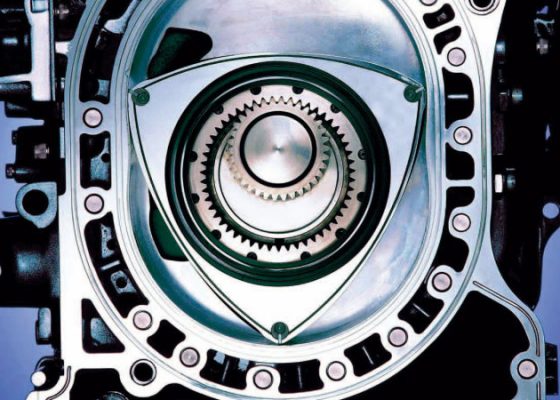

Chrysler LLC today announced that, as a result of the comprehensive restructuring plan agreed to by many of its stakeholders, it has reached an agreement in principle to establish a global strategic alliance with Fiat SpA to form a vibrant new company. It will allow Chrysler and Fiat to fully optimize their respective manufacturing footprints and the global supplier base, while providing each with access to additional markets. Fiat powertrains and components will also be produced at Chrysler manufacturing sites.

“This partnership transforms Chrysler into a vibrant new company with a wealth of strategic advantages,” said Bob Nardelli, Chairman and CEO of Chrysler. “It enables us to better serve our customers and dealers with a broader and more competitive line-up of environmentally friendly, fuel-efficient high-quality vehicles. Benefits to the new company include access to exciting products that complement our current portfolio, technology cooperation and stronger global distribution.”

Chrysler initiated discussions with Fiat more than a year ago to develop plans for a global product alliance. Over the past several months, these discussions have evolved and expanded. Chrysler and many of its stakeholders worked tirelessly to agree upon concessions that will result in a significantly lower cost base and enable fulfillment of a broader strategic alliance.

“We want to personally assure everyone that the new company will produce and support quality vehicles under the Jeep®, Dodge and Chrysler brands as well as parts under the Mopar® brand. Chrysler employees will become employees of the new company. Chrysler dealerships remain open for business serving our customers. All vehicle warranties will be honored without interruption and consumers can continue to purchase our vehicles with complete confidence,” explained Nardelli.

Chrysler’s trip through bankruptcy court may well not be as smooth as the President and his task force are projecting. Disgruntled bondholders and other parties could hold up the process via lawsuits, and a bankruptcy judge may not go along with what the administration has set up. However, one huge advantage for Fiat and Chrysler is that bankruptcy will allow them to shed redundant, unprofitable, and unproductive dealers. Many analysts believe that Chrysler has far too many dealers (as do GM and Ford), so Chapter 11 allows them to trim the network far more quickly than would otherwise be possible.

It’s a new New Chrysler starting today. I can’t wait to test drive a Fiat 500, but I’d be happy just to see this [sometimes] great company recover.

COPYRIGHT Full Metal Autos – All Rights Reserved